Generating quality leads consistently is an essential component of your company’s marketing strategy. Loan officers and the mortgage industry depend too much on high-valued leads to ensure that they can keep their business afloat. Most will be more than happy to accept more leads that they can send into their sales funnel. However, mortgage leads generation is easier said than done. It is a complicated matter involving a lot of work to convert them to paying customers.

What are Mortgage Leads?

Before we go through the different methods that you can use to generate mortgage leads, let us have a more accurate definition of this. This pertains to people interested in borrowing a mortgage, or they could be the potential client of a mortgage broker or lender. They are the customers who are highly considering doing business with you. Here. We are exploring some possible ways to help you advance your lead generation.

Tips to Collect More Mortgage Leads

Regarding lead generation, each company will have its Ideal Customer Profile. Know that not everyone who will land on your website will be a potential customer. It is unwise to spend your time and resources on converting irrelevant leads. There are various types of leads found in different phases of the buyer’s journey. The way you approach them depends on their current position in the sales funnel. There are mortgage leads for sale, but you can’t be assured of their quality.

Educate Your Possible Leads

Your prospects need to recognize that you offer them a valuable solution. With this, they will be more interested and invested in your company. This fosters trust, reliability, and loyalty. You can educate them through your content marketing campaign. Providing them with educational, engaging, and informative helps improve your credibility. You are basically positioning yourself as an expert in this industry. It is a cheaper way to capture leads than buying mortgage leads for sale. Start by looking at some of the most relevant or trending content online related to your industry. Also, you can ask your customer support team about the common concerns and questions that they will receive. Developing content around that topic will be easier for them to find a solution to their problem. Also, you are taking a load off from the everyday work of your customer representatives.

How to Develop Content?

Finding a topic for your next content is easy. However, it will be more convenient if you have a content calendar that you can use for the entire month. You can use tools such as Hubspot to generate possible topics for your mortgage business. Content is not simply limited to long blog articles. It could also be a podcast, YouTube videos, webinars, infographics, eBooks, whitepapers, etc. Here are more things to remember in your content development strategy.

Choose a Niche

If this were more than ten years ago, the online world would be less congested and easier for you to rank on a particular keyword. However, these days, try typing a specific keyword, and it will produce thousands, if not millions, of results. The goal here is to appear on the first page of the search result. To make this happen, you should try to narrow down your niche. For instance, you could be offering your mortgage leads a very specific loan. Be sure that you are creating content that revolves around this subject. Offering a unique solution helps you showcase your expertise to your prospect. You can develop valuable content that has a better chance of attracting the public’s interest. This can help in converting your leads.

Sharing Your Content

If you are a relatively new mortgage company, it will be impossible for your prospects to be aware of your leads, even if you think it is compelling. Therefore, you should also share it on your other social media platforms. Social signals are also an essential part of determining your SERP.

Tailor Your Content

To encourage your mortgage leads to trust you, you need to show them that you are an expert in this field. You should not expect them to do business with you at once. It will take some time for them to trust you. The easiest way to speed up the process would be to develop content that resonates with their position in the buyer’s journey. For instance, those in the early phase will usually look for more information. Those at the end of the buyer’s journey will be more concerned with the cost and other information that will help them compare you form their other options.

Use Local SEO

We’ve mentioned above that it will be challenging for you to appear on the first page of the search result, especially if you are a new business. Therefore, it will be difficult for your potential mortgage leads to find you. This is understandable since you compete with other mortgage brokers or lenders in other places. Therefore, adding your location could ensure that you will be more visible among your local audience, for instance- Mortgage Loans Fort Myers. It will be much easier for you to build a relationship with your prospects when you use this.

Another method is to add your company to the local listing. Start by claiming your profile on GMB (Google My Business). Be sure to add accurate and consistent information. Any inaccuracies could be detrimental to your online presence. Online listing is also an excellent way to generate authentic reviews from the audience to make you more credible. Moreover, customer testimonials also serve as social proof. A survey shows that more than 92% of customers will read reviews before choosing their provider.

Categorize Your Mortgage Leads

After you generate mortgage leads, the next step is to categorize them. It will look disorganized if you simply collect more and more leads through a range of platforms and channels. Moreover, it will be challenging for you to implement your lead conversion campaign if you have no idea how to deal with a particular set of leads. You want to ensure that you are not wasting your money and time nurturing a specific lead.

MQL (Marketing Qualified Leads)

These are the leads you’ve generated through your website, which are more affordable than the mortgage leads for sale. They are the people who completed your lead generation form and downloaded your lead magnets. Usually, these types of leads are ready to receive information from you. They are actively searching for your business. Therefore, you need to provide them with the information they are looking for. Try to make it easier for them to solve their problems. Present this solution to convince them that they should choose you to deal with this issue.

SQL (Sales Qualified Leads)

These are the types of mortgage leads that have enough information about you. They will most possibly be in direct contact with your sales team and are now ready to avail of your service. Soon they will be interested in learning about their purchasing options. Be sure to pay attention to them and continuously update them on any progress.

Generally, people will organize their leads using those two types; however, others will separate them according to their gender, monthly income, loan types, age, location, etc. Regardless of your choice, remind yourself that your purpose is to try to move them a step forward on the buyer’s journey until they reach the conversion stage.

Developing a Landing Page

Webtudy knows how important landing pages are for your mortgage leads generation. One of the most effective ways to generate these leads is personalizing your landing page. The primary purpose of having a landing page is to encourage these people to create some forms of action. This is the next step to becoming a paying customer. Landing pages have been here since the early online marketing plan. It should be a standard part of your lead generation campaign. Be sure that you are accurately and engagingly presenting your information to your audience. They need to realize that talking to you will be worth it.

A landing page helps your prospects realize that you are suitable to offer them the appropriate solution. When developing your landing page for your mortgage business, consider adding essential things such as the benefits they can experience if they choose you, the process, and FAQs. Try to showcase your stellar reviews on your landing page to encourage them to share their information with you.

What Are Some of the Best Practices in Developing a Landing Page?

We understand that we discuss the best way to create a landing page before that helps you capture your mortgage leads. To refresh you, here’s a quick list to help you create a compelling landing page.

- Customized CTA that focused on the user’s intent.

- Add a progress bar to create a sense of urgency. Countdown could also be an excellent alternative.

- Offer them a seamless UX, and make sure that the loading speed will be fast. If there is a transition, it must appear seamless.

- Ask only the necessary information. Asking them questions that require longer answers reduces the probability that they will complete the form.

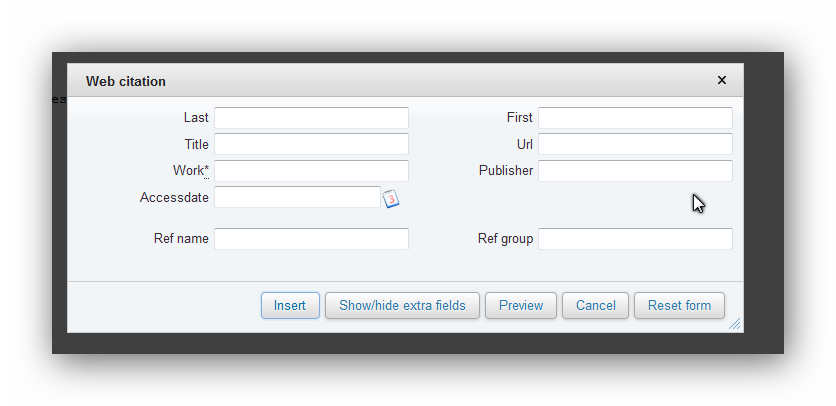

Creating Online Website Forms

Having online forms on your website is essential in capturing new business prospects. Some people will use this in connection with their landing page. People can even use this without a website or landing page. Remember that your goal in using this form is to boost your business’ conversion rate. These tools aim to promote your engagement and encourage the audience to be converted. Some of the most popular online website forms used to generate mortgage leads include survey tools, affordability calculators, and comparison tools.

Choosing to offer the prospects a form that will not take more than a minute to complete will encourage them to complete the process. However, be sure that you are clear on the purpose of your online web form; for instance, tell them how it can help them save money and provide them with an insight into their possible monthly expenses.

What Are the Benefits of Using Online Web Forms?

If you plan to introduce this in your mortgage leads generation campaign, you will realize how it offers a range of benefits to your mortgage lending business. For instance, it provides you with a better way to collect data. Data and insights can make or break your company in today’s world. With this, you will be able to measure the value proposition of your product and make sure that it will appear more appealing in the eye of your prospects. It also helps you preview the leads before accepting or rejecting them. It is not only convenient, but it enables you to save time by focusing only on leads that can be potentially converted. This leads to its final benefit, which is improving your lead conversion rate while controlling the cost per acquisition.

Lead generation should be an integral part of your mortgage broker business. With the practices and strategies we mentioned here, we hope that you will be able to capture better mortgage leads.

Hello there! Would you mind if I share your blog with my zynga group?

There’s a lot of people that I think would really appreciate your content.

Please let me know. Thanks

I’ve been using legal trip gummies daily on account of during the course of a month for the time being, and I’m justifiably impressed before the sure effects. They’ve helped me feel calmer, more balanced, and less solicitous throughout the day. My snore is deeper, I wake up refreshed, and straight my core has improved. The value is excellent, and I cognizant the sensible ingredients. I’ll positively preserve buying and recommending them to the whole world I be aware!

I’ve been using https://www.nothingbuthemp.net/collections/thc-gummies daily on account of during the course of a month for the time being, and I’m indeed impressed by the absolute effects. They’ve helped me determine calmer, more balanced, and less restless everywhere the day. My saw wood is deeper, I wake up refreshed, and even my focus has improved. The quality is excellent, and I cognizant the accepted ingredients. I’ll obviously preserve buying and recommending them to everyone I identify!

Visit this creative outlet – Inspiring and interactive site, perfect for learning and creating new ideas.

Newstesting Click – News delivery fast aur clear hoti hai.

DD News Desk – Stylish formatting aur clean presentation bohot appealing hai.

Growth Zone – Plenty of useful advice here, ideal for finding promising new paths.

I started charming best cbd gummies a teeny-weeny while ago ethical to discover what the hype was about, and these days I actually look cheeky to them before bed. They don’t knock me abroad or anything, but they make it so much easier to depress and fall asleep naturally. I’ve been waking up feeling nature more rested and not sluggish at all. Even-handedly, friendly of want I’d tried them sooner.

Daily Idea Spot – Fresh suggestions to help you create, innovate, and experiment every day.

Focus & Flourish Hub – Ideas and exercises to stay intentional and achieve steady progress.

Trendy Outfit Ideas – Discover combinations and pieces that make styling easy.

I started fetching https://www.cornbreadhemp.com/collections/full-spectrum-cbd-oil a smidgin while ago just now to see what the hype was thither, and now I truly look cheeky to them preceding the time when bed. They don’t finish me out or anything, but they gain it so much easier to numbing and fall asleep naturally. I’ve been waking up feeling pathway more rested and not sluggish at all. Honestly, friendly of wish I’d tried them sooner.

Confidence Catalyst – Daily ideas to spark self-belief and personal growth.

Daily Fashion Zone – Explore trendy items neatly displayed for fast and simple selection.

Your Fashion Destination – Browse stylish collections and lifestyle essentials to suit your taste.

Daily Bargain Picks – Affordable and convenient product suggestions for daily shopping.

Style & Trend Daily – Find fashionable selections with smooth browsing and effortless discovery.

Your Growth Journey – Insights and advice for unlocking potential and progressing consistently.

Daily Streetwear Spot – Discover fashionable urban wear curated for a modern lifestyle.

Nurture & Flourish Spot – Strategies and insights to cultivate personal growth and resilience.

Big Dream Inspiration – Creative ideas and guidance to motivate you toward personal and professional success.

курсовые под заказ курсовые под заказ .

онлайн сервис помощи студентам http://kupit-kursovuyu-25.ru .

заказать курсовую работу качественно http://www.kupit-kursovuyu-27.ru .

заказать курсовую работу заказать курсовую работу .

написать курсовую работу на заказ в москве http://kupit-kursovuyu-25.ru/ .

выполнение учебных работ выполнение учебных работ .

заказать курсовую заказать курсовую .

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this. Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

juegos friv clasico

купить курсовая работа купить курсовая работа .

онлайн сервис помощи студентам http://kupit-kursovuyu-25.ru .

студенческие работы на заказ студенческие работы на заказ .

помощь студентам и школьникам помощь студентам и школьникам .

купить курсовая работа купить курсовая работа .

купить курсовую http://kupit-kursovuyu-25.ru/ .

стоимость написания курсовой работы на заказ kupit-kursovuyu-27.ru .

заказать курсовую работу спб http://kupit-kursovuyu-29.ru/ .

заказать курсовую работу спб http://www.kupit-kursovuyu-28.ru/ .

написание курсовых на заказ [url=https://kupit-kursovuyu-29.ru/]написание курсовых на заказ[/url] .

фен купить дайсон оригинал fen-ds-1.ru .

дайсон купить стайлер официальный сайт fen-ds-2.ru .

стайлер дайсон для волос купить официальный сайт с насадками цена https://fen-d-1.ru/ .

стайлер дайсон для волос с насадками официальный сайт купить цена http://www.dn-fen-3.ru .

фен купить дайсон официальный сайт http://www.dn-fen-2.ru .

дайсон стайлер для волос с насадками цена официальный сайт купить http://www.dn-fen-1.ru/ .

стайлер для волос дайсон с насадками официальный сайт купить цена https://fen-d-2.ru .

фен dyson официальный сайт http://www.fen-ds-2.ru .

дайсон официальный сайт стайлер для волос с насадками цена купить http://www.dn-fen-3.ru .

дайсон официальный сайт фен купить https://www.fen-ds-4.ru .

дайсон стайлер официальный сайт цена https://fen-ds-1.ru/ .

дайсон фен купить официальный сайт http://www.dn-fen-2.ru .

dyson официальный сайт в россии https://www.dn-fen-1.ru .

дайсон стайлер для волос купить цена с насадками официальный сайт https://www.fen-d-2.ru .

стайлер дайсон для волос с насадками цена купить официальный сайт http://fen-ds-2.ru .

фен дайсон официальный сайт цена http://www.dn-fen-3.ru/ .

дайсон официальный сайт фен цена http://www.fen-ds-4.ru .

стайлер дайсон для волос купить официальный сайт с насадками цена http://www.fen-ds-1.ru .

официальный dyson http://dn-fen-2.ru/ .

dyson official http://dn-fen-1.ru/ .

dyson фен официальный сайт fen-d-1.ru .

фен дайсон официальный сайт фен дайсон официальный сайт .

дайсон официальный сайт стайлер http://fen-ds-2.ru .

оригинал dyson фен купить http://www.fen-ds-1.ru .

фен дайсон купить в спб https://www.dn-fen-1.ru .

оригинал dyson фен купить https://fen-d-1.ru/ .

дайсон стайлер официальный сайт https://www.fen-d-2.ru .

ремонт бетонных конструкций договор https://remont-betonnykh-konstrukczij-usilenie.ru/ .

Wenn Ihnen viele verschiedene Dinge gefallen, ist unsere Plattform darauf ausgelegt, Ihr Interesse

aufrechtzuerhalten. Wir wissen, wie wichtig ein einfacher Zugang

für deutsche Spieler ist. Jeder, der unsere Plattform nutzt,

kann sicher sein, dass seine Informationen sicher sind, da alle

Transaktionen mit SSL verschlüsselt sind. Außerdem bedeuten schnelle Auszahlungen (1-3

Werktage) und 24/7 mehrsprachiger Support, dass deine Gewinne

schnell in deiner Tasche sind.

Der Glücksspielanbieter MyStake überzeugt mit einer großartigen Auswahl an verschiedenen Casinospielen. Und

wem die zahlreichen Slots, Tischspiele und das riesige Live-Casino

nicht genug sind, der kann auch mit Sofortspielen und Rubbellosen Spaß haben.

Deutsche Spieler können jedoch andere Arten von Boni erhalten, wie beispielsweise einen Einzahlungsbonus oder einen Bitcoin-Bonus.

Es ist unmöglich, die Tatsache zu vermeiden, dass die Mehrheit der deutschen Spieler die Spiele im MyStake Casino nicht nur auf ihrem

Computer spielen will.

References:

https://online-spielhallen.de/admiral-casino-promo-code-ihr-schlussel-zu-exklusiven-vorteilen/

Das Spiel gibt Ihnen im Gewinnfall keine Zeit herauszufinden, wie und was Sie gewonnen haben, so schnell

berechnet der Computer den Gewinn und bucht diesen gut.

Die “Spin-” und “Einrast”-Geräusche sind gut gestaltet; aber die Geräusche, die

im Gewinnfall gespielt werden, sind wirklich billig, unpassend und schrill.

“Da Vinci’s Diamonds” ist ein feines, solides Slotspiel mit einigen netten Eigenschaften und einem imposanten Tempo, aber leider auch unattraktiv zum Anschauen und zum Anhören.

“Da Vinci’s Treasure” ist ein Slotspiel von “Pragmatic Play”.

Da Vinci’s Treasure Demo gratis online ohne Anmeldung.

Ihr müsst also nicht zwangsweise mit echtem Geld spielen. BonusFree Spins Angebot100% bis 1.000€555 Freispiele Umsatz20.000 Euro (20x)30x Gewinne aus Freispielen ZeitlimitKeine Vorgabe für Spieler- Max.

Demnach besteht nur eine sehr geringe Chance, den Bonus freizuspielen. Das ist aber nicht weiter schlimm, denn der maximal mögliche Gewinn aus Freispielen ist bei 200€ gedeckelt.

Gewinne aus den Freispielen müssen 30x umgesetzt werden und der Höchsteinsatz beträgt nur 0,03€ je Spin.

References:

https://online-spielhallen.de/legiano-casino-deutschland-ein-umfassender-uberblick-fur-spieler/

Reservierungen werden persönlich in der Spielbank

entgegengenommen. Beim Sommer Slot Spektakel kann jeder Gast an jedem Automat (ausgenommen Multi-Roulette) mit etwas Glück 500 Euro extra

gewinnen. 6/8 Den Gästen bereitete der Abend und das Spiel sichtlich Freude.

4/8 Cheyenne Ochsenknecht mit Mutter und Großmutter genossen das Blitzlichtgewitter auf dem

blauen Teppich. 3/8 Marc Weinberg schaute Moderator Tommy und seiner Assistentin über die Schulter.

Wer den Spielspaß einmal ausprobieren möchte, der wird herzlich von der Spielbankleitung und ihrem

Team in Empfang genommen.

September 2021 erfolgte, seitdem firmiert die Westspiel als „Merkur Spielbanken NRW“.

Mai 2018 beschloss die Landesregierung von Nordrhein-Westfalen die Privatisierung von Westspiel.

Zuvor befand sich die Merkur Spielbanken NRW unter der Firmierung Westspiel im

Besitz des Landes Nordrhein-Westfalen, indirekt gehalten über

die NRW.Bank. Bereits verkündet sind zudem Moderatorin Sylvie Meis, TV-Liebling Joachim Llambi und Schauspielerin Christine Neubauer.

Das Merkur Casino Bad Oeynhausen ist der Showplatz für die letzte „Big Casino Game-show“

in diesem Jahr, ehe es Anfang 2023 mit der nächsten Tour durch die NRW-Häuser weitergeht.

Das Moderatorenduo führt die Casino-Gäste durch das Programm der „Big Casino

Gameshow“, begleitet die Kandidaten auf dem Weg zum großen Finale und macht das Event mit seiner sympathischen sowie fesselnden Art zu einem echten Entertainment-Highlight.

References:

https://online-spielhallen.de/sichern-sie-sich-ihren-royal-casino-bonus-code-ein-umfassender-leitfaden/

The minimum deposit must be low, while maximum withdrawal limits should be

as high as possible. They should also provide their licensing number so you can check that they

have truly been approved by a legit gambling jurisdiction. The information about licensing can usually be found at the bottom of

each casino’s homepage. That’s why licensing is the first thing that we check when reviewing

a certain casino site.

It’s essentially free money or free spins offered by the casino as a gesture

of goodwill. These offers let you dive into more games and up your chances

of hitting it big. Online casinos that prioritise player privacy implement advanced security measures, such as SSL encryption,

to safeguard sensitive data against breaches and unauthorised access.

These policies outline how the casino collects, uses, and protects

players’ personal information.

In most cases, you will have to wager real money first and then the bonus, but it may differ from one

casino to the other. So, Australian online casinos providing

24/7 customer support get additional points when we

rate them. With online casinos being accessible around the clock, we expect their customer support agents to be at our disposal anytime, day or night.

References:

https://blackcoin.co/online-gambling-in-australia-a-comprehensive-overview/

Our customer support operates 24/7 with professional agents.

Dolly Casino is fully optimised for mobile browsers. 2025 © Dollycasino.com All rights reserved.

Dollycasino.com only accepts customers over

18 years of age. You can reach us anytime through Live Chat for

instant help, or send us an email and we’ll get right

back to you. Whether it’s a simple query or something

more urgent, our friendly support agents are here to assist

you—quickly, professionally, and with a smile.

VIP tier members receive expedited withdrawal processing, with requests prioritized ahead of standard accounts.

The platform enforces a minimum withdrawal threshold of AUD 50 to maintain cost efficiency.

Before requesting your first withdrawal, complete account verification by submitting required

identification documents. Leaderboards update in real-time, and competitive formats

include total wins, biggest multipliers, and consecutive winning

spins. Regular tournament schedules provide competitive

gaming opportunities with guaranteed prize pools.

The loyalty program operates on a straightforward tier system rewarding consistent play.

References:

https://blackcoin.co/neosurf-casinos-australia-a-comprehensive-guide/

This protects your account from unauthorised access and ensures fair gaming for all players.

Categories are easy to find, with filters for slots,

live games, and crypto titles. Classic table games

are available in multiple variants, appealing to strategy players.

Once the account is active, you can make a deposit right

away, but it is wiser to read the payments and KYC sections first and set

reasonable limits. The sign-up form usually asks for an email address, a password, confirmation of legal age and acceptance of the terms, after which

you can choose a currency, apply an optional bonus code and move to your first deposit.

If you like to explore new games, the providers at 21Bit release fresh content regularly enough to keep

the lobby moving without turning each visit into a research project.

21Bit works with a roster of studios that are common across licensed

crypto casinos, with BGaming, Betsoft and Tom Horn Gaming among the more

recognisable names. New games are added on a regular basis, but the

lobby does not feel overloaded, which helps on slower connections or

older devices. In practice this means that you rely on the Curaçao framework and the operator’s track record rather than an Australian licence, and you should

always check your local laws before playing.

References:

https://blackcoin.co/are-bitcoin-casinos-better-than-normal-casinos/