Generating quality leads consistently is an essential component of your company’s marketing strategy. Loan officers and the mortgage industry depend too much on high-valued leads to ensure that they can keep their business afloat. Most will be more than happy to accept more leads that they can send into their sales funnel. However, mortgage leads generation is easier said than done. It is a complicated matter involving a lot of work to convert them to paying customers.

What are Mortgage Leads?

Before we go through the different methods that you can use to generate mortgage leads, let us have a more accurate definition of this. This pertains to people interested in borrowing a mortgage, or they could be the potential client of a mortgage broker or lender. They are the customers who are highly considering doing business with you. Here. We are exploring some possible ways to help you advance your lead generation.

Tips to Collect More Mortgage Leads

Regarding lead generation, each company will have its Ideal Customer Profile. Know that not everyone who will land on your website will be a potential customer. It is unwise to spend your time and resources on converting irrelevant leads. There are various types of leads found in different phases of the buyer’s journey. The way you approach them depends on their current position in the sales funnel. There are mortgage leads for sale, but you can’t be assured of their quality.

Educate Your Possible Leads

Your prospects need to recognize that you offer them a valuable solution. With this, they will be more interested and invested in your company. This fosters trust, reliability, and loyalty. You can educate them through your content marketing campaign. Providing them with educational, engaging, and informative helps improve your credibility. You are basically positioning yourself as an expert in this industry. It is a cheaper way to capture leads than buying mortgage leads for sale. Start by looking at some of the most relevant or trending content online related to your industry. Also, you can ask your customer support team about the common concerns and questions that they will receive. Developing content around that topic will be easier for them to find a solution to their problem. Also, you are taking a load off from the everyday work of your customer representatives.

How to Develop Content?

Finding a topic for your next content is easy. However, it will be more convenient if you have a content calendar that you can use for the entire month. You can use tools such as Hubspot to generate possible topics for your mortgage business. Content is not simply limited to long blog articles. It could also be a podcast, YouTube videos, webinars, infographics, eBooks, whitepapers, etc. Here are more things to remember in your content development strategy.

Choose a Niche

If this were more than ten years ago, the online world would be less congested and easier for you to rank on a particular keyword. However, these days, try typing a specific keyword, and it will produce thousands, if not millions, of results. The goal here is to appear on the first page of the search result. To make this happen, you should try to narrow down your niche. For instance, you could be offering your mortgage leads a very specific loan. Be sure that you are creating content that revolves around this subject. Offering a unique solution helps you showcase your expertise to your prospect. You can develop valuable content that has a better chance of attracting the public’s interest. This can help in converting your leads.

Sharing Your Content

If you are a relatively new mortgage company, it will be impossible for your prospects to be aware of your leads, even if you think it is compelling. Therefore, you should also share it on your other social media platforms. Social signals are also an essential part of determining your SERP.

Tailor Your Content

To encourage your mortgage leads to trust you, you need to show them that you are an expert in this field. You should not expect them to do business with you at once. It will take some time for them to trust you. The easiest way to speed up the process would be to develop content that resonates with their position in the buyer’s journey. For instance, those in the early phase will usually look for more information. Those at the end of the buyer’s journey will be more concerned with the cost and other information that will help them compare you form their other options.

Use Local SEO

We’ve mentioned above that it will be challenging for you to appear on the first page of the search result, especially if you are a new business. Therefore, it will be difficult for your potential mortgage leads to find you. This is understandable since you compete with other mortgage brokers or lenders in other places. Therefore, adding your location could ensure that you will be more visible among your local audience, for instance- Mortgage Loans Fort Myers. It will be much easier for you to build a relationship with your prospects when you use this.

Another method is to add your company to the local listing. Start by claiming your profile on GMB (Google My Business). Be sure to add accurate and consistent information. Any inaccuracies could be detrimental to your online presence. Online listing is also an excellent way to generate authentic reviews from the audience to make you more credible. Moreover, customer testimonials also serve as social proof. A survey shows that more than 92% of customers will read reviews before choosing their provider.

Categorize Your Mortgage Leads

After you generate mortgage leads, the next step is to categorize them. It will look disorganized if you simply collect more and more leads through a range of platforms and channels. Moreover, it will be challenging for you to implement your lead conversion campaign if you have no idea how to deal with a particular set of leads. You want to ensure that you are not wasting your money and time nurturing a specific lead.

MQL (Marketing Qualified Leads)

These are the leads you’ve generated through your website, which are more affordable than the mortgage leads for sale. They are the people who completed your lead generation form and downloaded your lead magnets. Usually, these types of leads are ready to receive information from you. They are actively searching for your business. Therefore, you need to provide them with the information they are looking for. Try to make it easier for them to solve their problems. Present this solution to convince them that they should choose you to deal with this issue.

SQL (Sales Qualified Leads)

These are the types of mortgage leads that have enough information about you. They will most possibly be in direct contact with your sales team and are now ready to avail of your service. Soon they will be interested in learning about their purchasing options. Be sure to pay attention to them and continuously update them on any progress.

Generally, people will organize their leads using those two types; however, others will separate them according to their gender, monthly income, loan types, age, location, etc. Regardless of your choice, remind yourself that your purpose is to try to move them a step forward on the buyer’s journey until they reach the conversion stage.

Developing a Landing Page

Webtudy knows how important landing pages are for your mortgage leads generation. One of the most effective ways to generate these leads is personalizing your landing page. The primary purpose of having a landing page is to encourage these people to create some forms of action. This is the next step to becoming a paying customer. Landing pages have been here since the early online marketing plan. It should be a standard part of your lead generation campaign. Be sure that you are accurately and engagingly presenting your information to your audience. They need to realize that talking to you will be worth it.

A landing page helps your prospects realize that you are suitable to offer them the appropriate solution. When developing your landing page for your mortgage business, consider adding essential things such as the benefits they can experience if they choose you, the process, and FAQs. Try to showcase your stellar reviews on your landing page to encourage them to share their information with you.

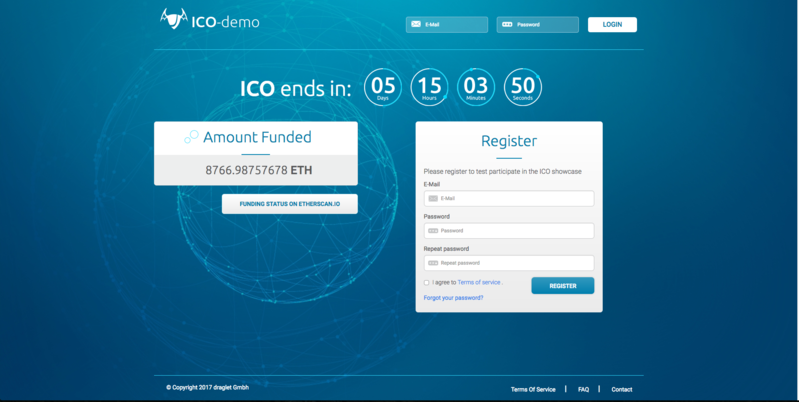

What Are Some of the Best Practices in Developing a Landing Page?

We understand that we discuss the best way to create a landing page before that helps you capture your mortgage leads. To refresh you, here’s a quick list to help you create a compelling landing page.

- Customized CTA that focused on the user’s intent.

- Add a progress bar to create a sense of urgency. Countdown could also be an excellent alternative.

- Offer them a seamless UX, and make sure that the loading speed will be fast. If there is a transition, it must appear seamless.

- Ask only the necessary information. Asking them questions that require longer answers reduces the probability that they will complete the form.

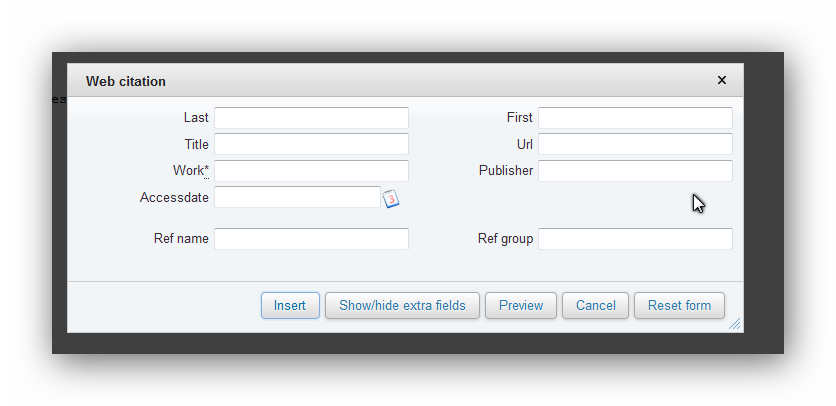

Creating Online Website Forms

Having online forms on your website is essential in capturing new business prospects. Some people will use this in connection with their landing page. People can even use this without a website or landing page. Remember that your goal in using this form is to boost your business’ conversion rate. These tools aim to promote your engagement and encourage the audience to be converted. Some of the most popular online website forms used to generate mortgage leads include survey tools, affordability calculators, and comparison tools.

Choosing to offer the prospects a form that will not take more than a minute to complete will encourage them to complete the process. However, be sure that you are clear on the purpose of your online web form; for instance, tell them how it can help them save money and provide them with an insight into their possible monthly expenses.

What Are the Benefits of Using Online Web Forms?

If you plan to introduce this in your mortgage leads generation campaign, you will realize how it offers a range of benefits to your mortgage lending business. For instance, it provides you with a better way to collect data. Data and insights can make or break your company in today’s world. With this, you will be able to measure the value proposition of your product and make sure that it will appear more appealing in the eye of your prospects. It also helps you preview the leads before accepting or rejecting them. It is not only convenient, but it enables you to save time by focusing only on leads that can be potentially converted. This leads to its final benefit, which is improving your lead conversion rate while controlling the cost per acquisition.

Lead generation should be an integral part of your mortgage broker business. With the practices and strategies we mentioned here, we hope that you will be able to capture better mortgage leads.